ChartTalk: Looking For A Medium Term Buy For Your Portfolio? Check Out This Stock

The Indian equity markets have stayed highly volatile throughout this calendar year; the calm was disrupted when geopolitical tensions broke out between Russia and Ukraine in February. After that, the equities across the world stayed highly volatile and under pressure due to a slew of interest rate hikes from the Federal Reserve which was followed by the central banks from the rest of the world including India’s RBI. Such an environment kept the equity markets on tenterhooks; however, India has remained one of the best relatively outperforming markets compared to its peers.

However, the most recent moves in the markets, regardless of the volatility that they were accompanied by, have created few good investment opportunities for the near-term horizon. May stocks from the broad market universe have shown signs of a potential reversal and some decent technical pullback. This generic injectable manufacturer is one such stock that may make a good addition to any investor’s portfolio for the medium term.

ChartTalk – This Is Free!!

Our FREE technical newsletter – Get actionable and profit-generating trade ideas TWICE in a month in your mailbox.

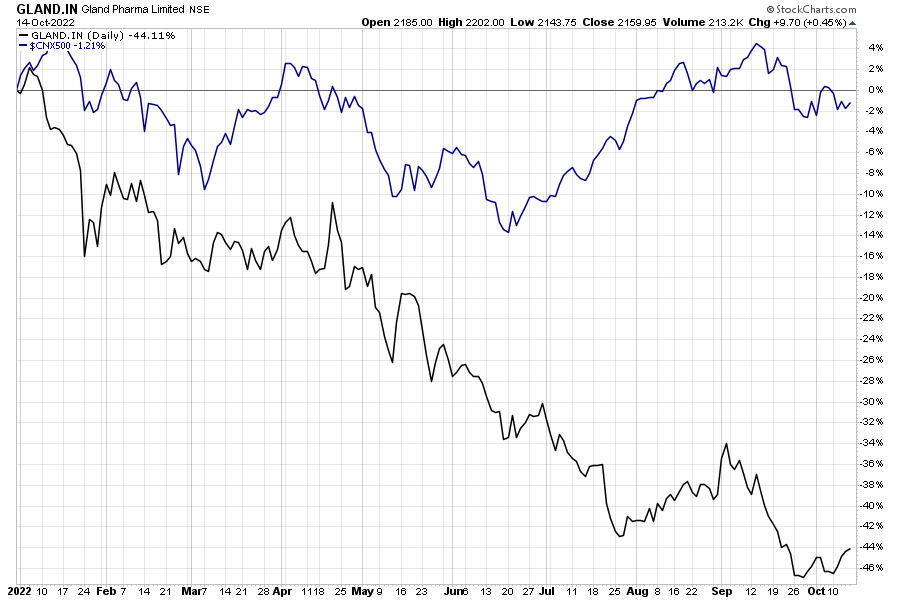

The above Relative comparison chart of Gland Pharma and the NIFTY 500 Index shows that the stock has grossly underperformed in the broader markets. While the NIFTY 500 Index has lost just 1.21% on a YTD basis, the GLAND stock has lost 44.11% over the same period.

After forming a high near 4350 and making a lower top thereafter at 4062, GLAND has remained under a sustained corrective decline. A few technical developments on the stock show that a potential bottom might be in place.

A bullish engulfing candle has emerged on the weekly charts; this has occurred after a significant decline. This makes this bullish engulfing candle a valid one and this marks a potential reversal point for the stock.

Importantly, the recent decline in price has come with a strong bullish divergence of the RSI against the price as RSI did not make lower bottom while the price did. The stock has rolled inside the improving quadrant of the RRG. This potentially puts an end to the relative underperformance of the stock.

The stock seems to have laid the ground for a significant technical pullback even if there is no major trend reversal in the offing. If the pullback happens on the expected lines, the stock may see itself testing 2600 levels. This translates into a potential return of ~20% from the current levels.

Foram Chheda, CMT